Offshore Banking - The Facts

Table of ContentsLittle Known Facts About Offshore Banking.What Does Offshore Banking Mean?About Offshore Banking5 Easy Facts About Offshore Banking DescribedOffshore Banking Things To Know Before You Get ThisThe 3-Minute Rule for Offshore BankingThe Main Principles Of Offshore Banking The 20-Second Trick For Offshore BankingThe Best Strategy To Use For Offshore Banking

This procedure aids produce liquidity in the marketwhich produces cash as well as maintains the supply going. Much like any other company, the objective of a financial institution is to earn a revenue for its owners. For the majority of banks, the owners are their investors. Financial institutions do this by billing more rate of interest on the lendings and various other financial debt they release to borrowers than what they pay to people that utilize their cost savings vehicles.

Offshore Banking Things To Know Before You Buy

Banks make a revenue by charging more rate of interest to customers than they pay on interest-bearing accounts. A financial institution's dimension is determined by where it is located as well as that it servesfrom little, community-based institutions to large commercial financial institutions. According to the FDIC, there were simply over 4,200 FDIC-insured commercial financial institutions in the USA as of 2021.

Typical financial institutions use both a brick-and-mortar place and an on-line existence, a brand-new pattern in online-only financial institutions arised in the early 2010s. These banks typically offer customers greater rate of interest as well as lower costs. Convenience, rate of interest, and also fees are a few of the aspects that help customers decide their liked banks.

The 6-Second Trick For Offshore Banking

This website can assist you find FDIC-insured financial institutions as well as branches. The goal of the Stocks Investor Protection Corporation (SIPC) is to recuperate money as well as securities in case a participant broker agent company falls short. SIPC is a nonprofit company that Congress created in 1970. SIPC safeguards the customers of all registered brokerage firms in the U.S

The smart Trick of Offshore Banking That Nobody is Talking About

You ought to consider whether you want to keep both business as well as personal accounts at the exact same bank, or whether you desire them at separate financial institutions. A retail financial institution, which has fundamental banking solutions for customers, is one of the most suitable for daily banking. You can choose a typical bank, which has a physical building, or an online financial institution if you don't want or need to literally go to a bank branch.

A community financial institution, for instance, takes down payments and offers in your area, which might supply a much more personalized banking connection. Pick a practical place if you are picking a bank with a brick-and-mortar location. If you have an economic emergency, you do not want to need to take a trip a cross country to get money.

All About Offshore Banking

Some banks also supply smart device applications, which can be beneficial. Check the costs associated with the accounts you intend to open up. see here Financial institutions bill passion on loans along with regular monthly upkeep charges, overdraft account charges, as well as cord transfer charges. Some big banks are relocating to end over-limit charges in 2022, to ensure that could be an important consideration.

After making some minimal deductions (in the form of compensation), the bank pays the bill's value to the holder. When the costs of exchange develops, the bank gets its settlement from the event, which had accepted the expense.

Offshore Banking for Dummies

Banks aid their consumers in moving funds from one place to another through cheques, drafts, etc. A bank card is a card that allows its owners to make purchases of products as well as services for the credit score card's supplier promptly spending for the goods or service. The cardholder debenture back the purchase total up to the card service provider over a long time and also with passion.

Mobile banking (also referred to as M-Banking) is a term used for carrying out balance checks, account deals, settlements, credit report applications, as well as other banking deals with a mobile phone such as a mobile phone or Personal Digital Assistant (PDA), Accepting down payments from savers or account owners is the primary feature of a financial institution.

The Of Offshore Banking

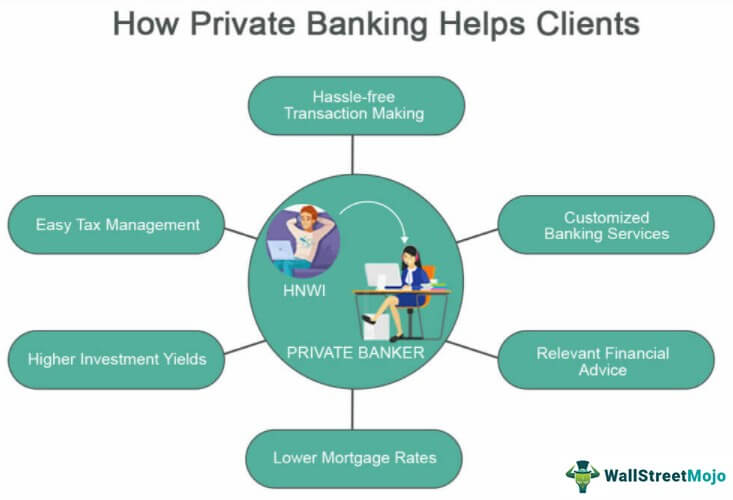

Individuals favor to transfer explanation their financial savings in a bank due to the fact that by doing so, they earn passion. Priority financial can consist of a number of numerous services, however some preferred ones include totally free monitoring, on the internet expense pay, financial appointment, as well as details. Personalized financial as well as financial solutions are traditionally offered to a financial institution's electronic, high-net-worth individuals (HNWIs).

Exclusive Banks intend to match such people with the most appropriate choices. offshore banking.

The Definitive Guide to Offshore Banking

Not just are money market this content accounts Federal Deposit Insurance coverage Corporation-insured, however they gain higher rates of interest than inspecting accounts. Money market accounts decrease the threat of investing because you constantly have accessibility to your money you can withdraw it at any type of time without fine, though there may some restrictions on the number of transactions you can make monthly - offshore banking.

Corporate banking typically provides greater earnings for banks as a result of the big amounts of cash as well as interest involved with business loans. In some cases the 2 divisions overlap in regards to their services, yet the actual distinction remains in the clients as well as the revenues each financial type makes. A business banker jobs closely with clients to determine which financial services and products best fit their demands, such as company monitoring accounts, credit score cards, treasury management, loans, even payment handling.

How Offshore Banking can Save You Time, Stress, and Money.

You want to select a financial institution that provides a complete variety of solutions so it supports your banking needs as your service grows. ACH enables money to be transferred digitally without making use of paper checks, cord transfers or money.